Malicious actors are constantly coming up with new ways to scam people, upgrading their tactics alongside the evolving technology. Despite the various efforts to combat fraudulent activities, many people still find themselves falling victim to such schemes. What’s more, these individuals may end up getting targeted a second time.

This is what is known as a secondary scam. In essence, these are schemes designed to trap those who have already been scammed. They use the victims’ previous experience as bait, preying on their urgency to recover their losses.

No actual recourse

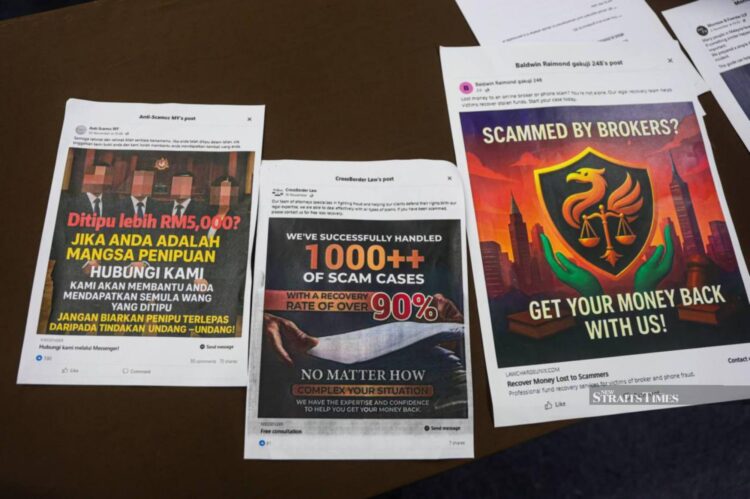

As with regular fraud, secondary scams come in a variety of forms. Scammers may pose as authorities or advisors offering assistance. MCA Public Services and Complaints Department head Datuk Seri Michael Chong has warned the public of a particular type of secondary scam. Basically, these syndicates create professional-looking websites claiming to help victims “recover” their lost funds.

These sites advertise services for a myriad of fraud cases and rely on fake statistics and testimonials to feign legitimacy. Of course, none of these services are actually real. As Chong puts it, these sites only serve to exploit the victims’ desperation to further cause further financial and psychological harm.

Aside from that, these fraudulent platforms also harvest the victims’ personal data for other illicit purposes. According to Chong, there has been a “worrying trend” of victims receiving calls from illegal moneylenders after providing their details to these sites. He went on to remind that the chance of recovering lost funds from these platforms is zero.

Vigilance is key

Whatever the case, vigilance remains the first line of defence against fraud. The public should be wary of unknown online information and always verify its source. If a claim seems suspicious or too good to be true, then it should not be easily trusted. In the case of these so-called “recovery” websites, there is no guarantee that victims will get their money back.

Whatever the case, vigilance remains the first line of defence against fraud. The public should be wary of unknown online information and always verify its source. If a claim seems suspicious or too good to be true, then it should not be easily trusted. In the case of these so-called “recovery” websites, there is no guarantee that victims will get their money back.

Aside from that, Malaysians can check the Semak Mule database to determine whether a phone number, bank account, or company is linked to a scam. It is worth noting that while flagged accounts are confirmed to be connected to fraudulent activities, a clean result does not necessarily mean it is safe. Either way, it is better to err on the side of caution.

If you have been scammed

Of course, while prevention is better than cure in these cases, it can be difficult to stay ahead of scams, especially in this day and age. With the advent of generative AI, it has become increasingly easier to fool unsuspecting people. Chong noted that fraud groups are constantly flooding online spaces with misleading ads. These groups are always developing more advanced methods, often using stolen material of prominent figures.

Even with increasing public awareness, scams remain widespread in Malaysia. As of November 2025, the Bukit Aman Commercial Crime Investigation Department (CCID) reported over 67,735 cases of online fraud, amounting to losses of more than RM2.7 billion. E-commerce crimes also saw a steep 97% increase last year.

If you have fallen victim to a scam, you must act swiftly. It goes without saying that you should immediately contact your bank to halt any suspicious transactions. Aside from that, you can file a report with the National Scam Response Centre (NSRC) via the 997 hotline.

For further investigation, you must submit a police report. Be sure to document all relevant information. This includes the contact details of the scammer, records of communication, as well as other evidence.

(Source: The Star)