In Malaysia, it has become all too common: a bank system crashes or a telco network falters, and customers are left in the dark. Literally. For hours, sometimes longer, banks and telcos stay silent, leaving people unsure whether the problem will take minutes or days to fix.

Silence in these critical moments is not just frustrating. It’s a failure of responsibility and accountability.

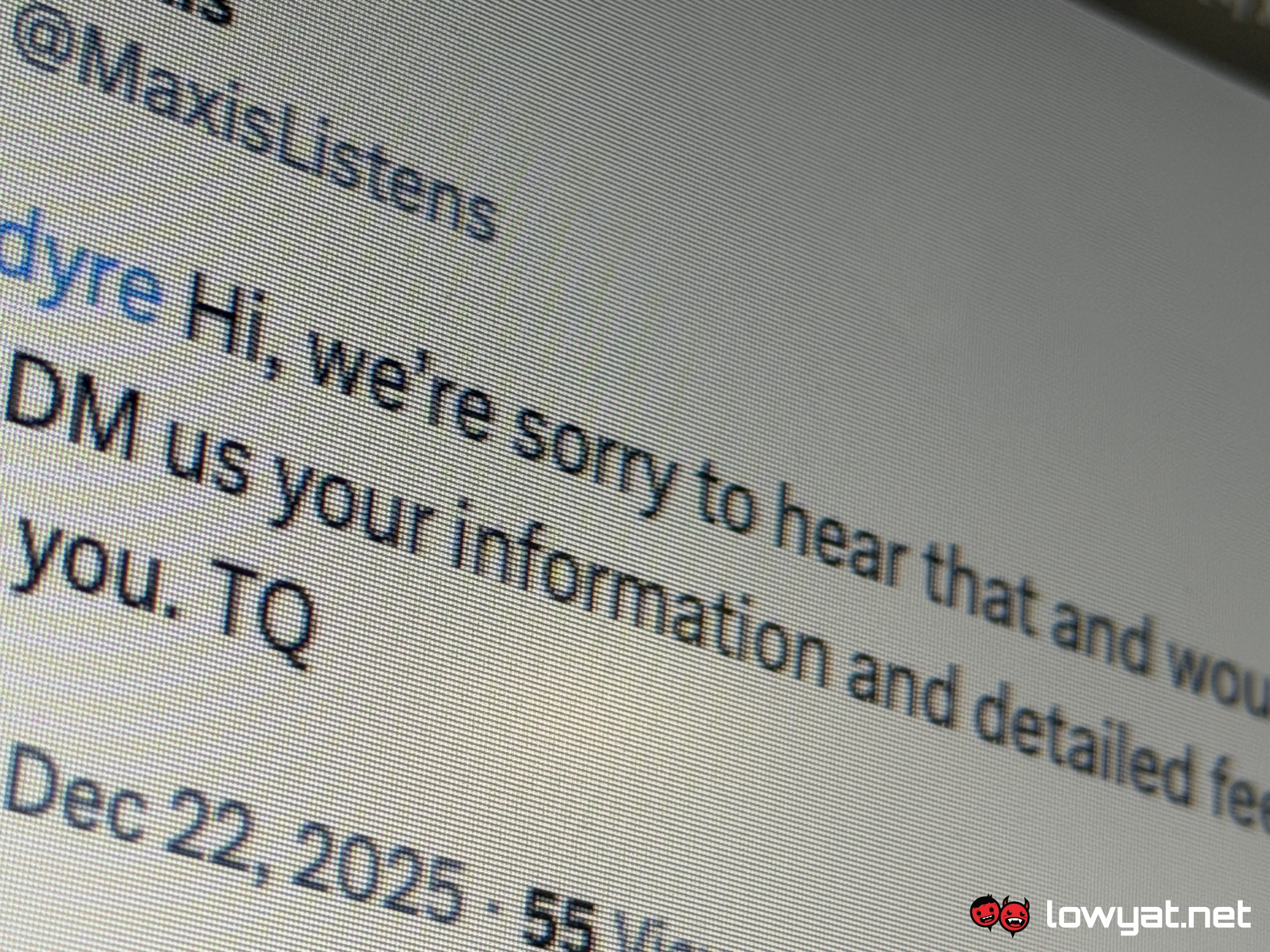

Telcos and banks rarely issue timely statements during outages. When they do, the messages are often vague, lacking clarity on the cause, affected services, or estimated recovery times. Even when the media (including ourselves) reach out directly, responses are slow and superficial. Meanwhile, customers scramble to find answers from official channels or social media, often without success.

The problem isn’t just about inconvenience. For banks, system downtimes can prevent customers from making payments, accessing accounts, or using mobile apps. For telcos, service interruptions can leave people cut off from communication entirely. The situation is worsened when third-party providers (like payment platform PayNet, which handles DuitNow) experience issues. Ironically, when these partners fail, banks and telcos often lose access to information too, spreading uncertainty to the public.

Yet, when customers do try to report problems, the process feels transactional rather than transparent. Companies request account details or complaint numbers, yet provide little in return. This information exchange remains private, leaving customers with no public assurance or clarity on the resolution.

Regulatory bodies such as the Malaysian Communications and Multimedia Commission (MCMC) have a role to play in addressing these recurring transparency gaps. Social media tags to ministers and regulators during outages highlight the demand for visibility, but a systematic approach is still missing.

If there is one area that essential service providers could improve immediately, it is communication. Being upfront about outages, providing regular updates, and clarifying the involvement of third-party partners would go a long way in restoring customer confidence. With the new year approaching, it is time for banks, telcos and other crucial services in Malaysia to recognise that transparency is not optional. It is part of the trust we place in them.

Downtimes will happen. Failures are inevitable. But silence, uncertainty, and vague statements are not. Customers deserve to know when the lights go out, and when they will come back on.