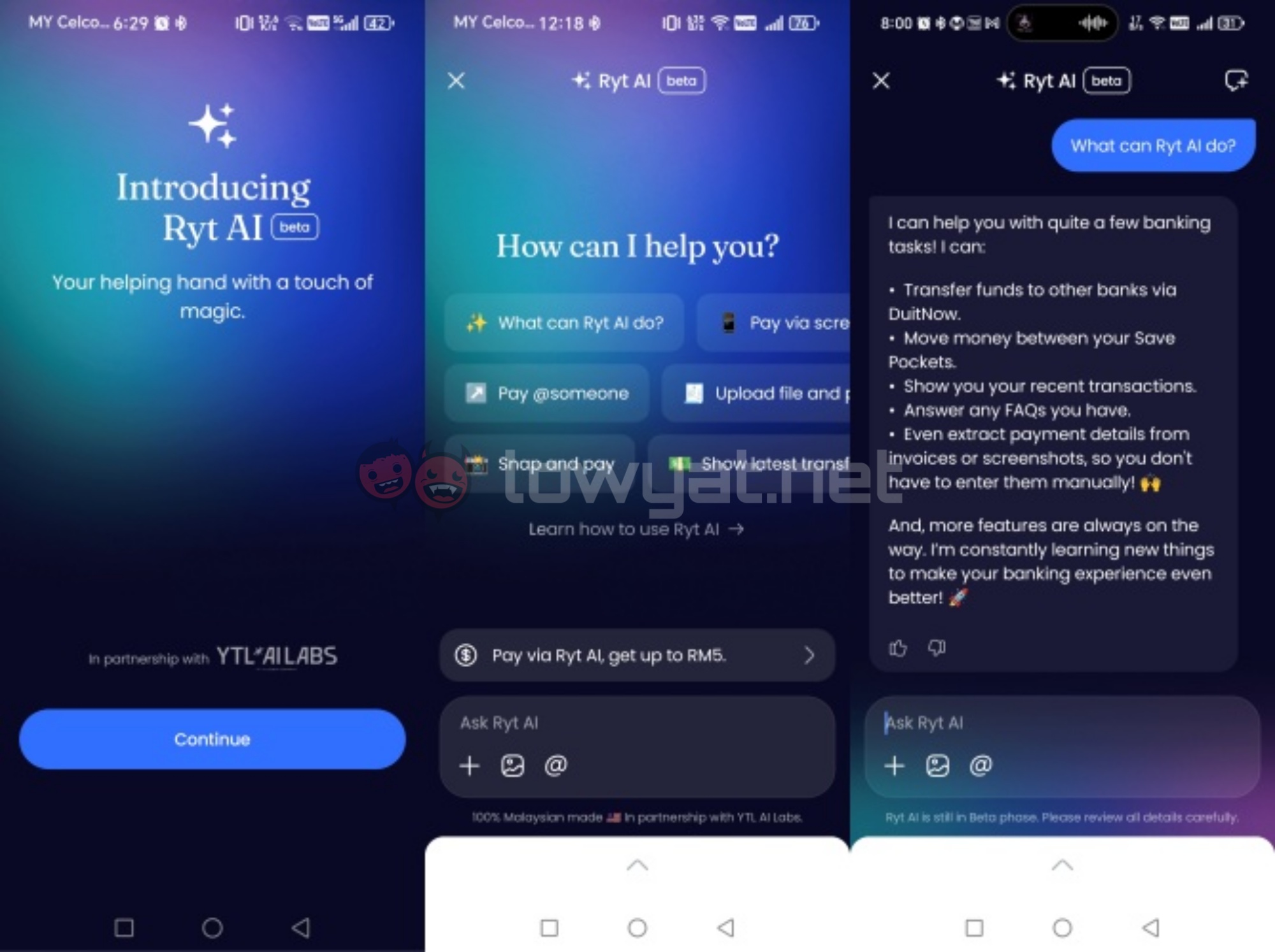

YTL Group and Sea Limited have officially launched Ryt Bank, an AI-powered digital bank. As we have previously covered, it is the first of its kind in Malaysia, with a banking experience centred around the Ryt AI always-on assistant.

As with any other chatbot, the user can interact and converse with Ryt AI. It can understand inputs in English, Bahasa Malaysia, as well as Manglish. Aside from responding to queries, it is capable of handling transactions like funds transfers and bill payments at the user’s request.

Beyond the AI assistant, Ryt Bank has an interest rate of up to 4% per annum, which is paid to the account daily. Other than that, the bank also provides the Visa-powered All-in-One Ryt Card, which offers unlimited 1.2% cashback overseas.

Beyond the AI assistant, Ryt Bank has an interest rate of up to 4% per annum, which is paid to the account daily. Other than that, the bank also provides the Visa-powered All-in-One Ryt Card, which offers unlimited 1.2% cashback overseas.

A new addition is Ryt PayLater, which is the bank’s Buy Now, Pay Later (BNPL) feature. Eligible users can immediately activate this feature without any documents. The bank offers a credit limit of RM1,499, with 0% interest for the first month.

Security features include biometric login, multi-layered encryption, and real-time fraud alerts. As the bank is licensed by Bank Negara Malaysia, it provides PIDM protection up to RM250,000 for each depositor.

As part of the official launch, Ryt Bank is offering a few perks to new users. Those trying out Ryt AI for transactions can earn up to RM5. Additionally, for a limited time, customers can acquire their Ryt Card free of charge.

Those interested can download the app from the Apple App Store and Google Play Store. Currently, the platform is available in English and Bahasa Malaysia, with support for Mandarin coming this September.

(Source: Ryt Bank press release)