Ryt Bank is set to launch as Malaysia’s first AI-powered digital bank soon. What “AI-powered” here means is that the bank will feature its Ryt AI chatbot as an integral part of the banking experience.

Ahead of its official release to the general public, the digital bank briefly offered a preview of what it has to offer at the ASEAN AI Malaysia Summit 2025. For those who missed the opportunity, here’s an overview of the banking experience.

First, you will need to sign up for an account, which is done via the app. It is currently available on both Google Play Store and Apple App Store. Ryt Bank promises a quick registration process, thanks to the electronic Know Your Customer (eKYC) procedure.

First, you will need to sign up for an account, which is done via the app. It is currently available on both Google Play Store and Apple App Store. Ryt Bank promises a quick registration process, thanks to the electronic Know Your Customer (eKYC) procedure.

To sign up, you will need to provide your phone number. After that, the app will prompt you to scan your IC. Once that’s done, you will need to take a selfie. You will then need to check your personal details and answer a few questions relating to your employment status and income.

You will have to wait a bit after filling in the requested information. This can take as little as a few minutes, or as long as 48 hours. In my case, it took about five minutes before I was greeted with a welcome page. Of course, the app makes sure to let you know about its Ryt AI, but we’ll get to that in a bit.

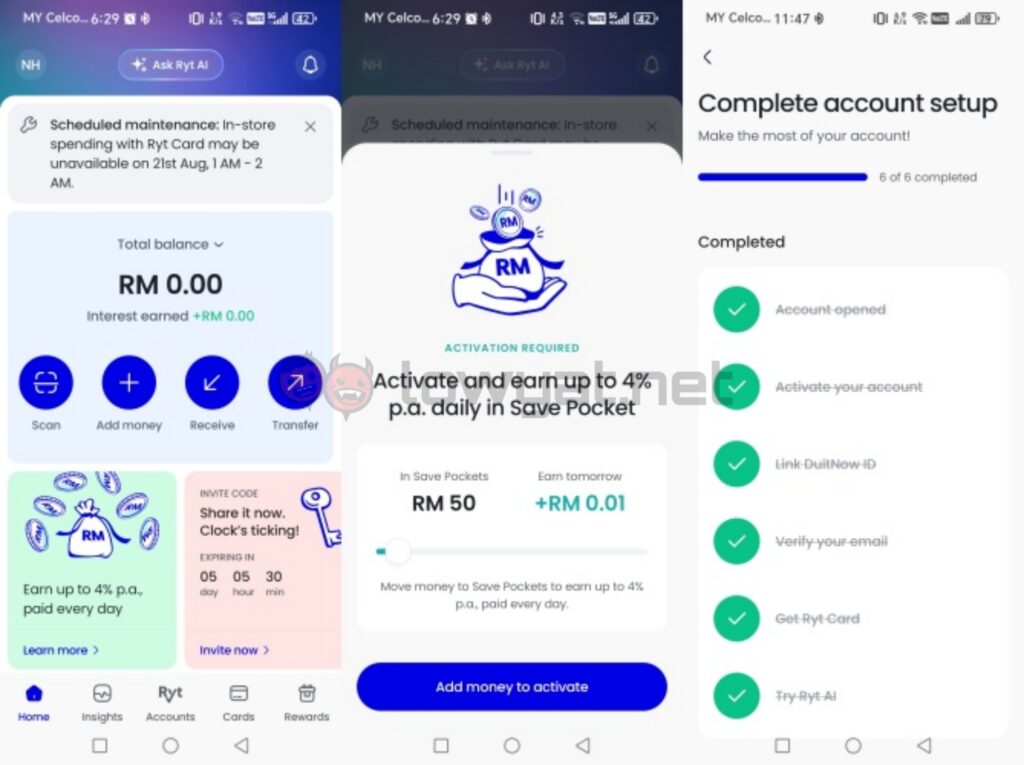

Ryt Bank more or less resembles any other banking app, so you can expect to find similar features like transfers and QR payments. For new users, the app will guide you through the steps to complete setting up your account. These are pretty straightforward things like adding funds to your account.

Speaking of which, you get your main savings account, as well as a Ryt Pocket. The bank offers an interest rate of 3% per annum, which is credited to the account each day. Meanwhile, the Ryt Pocket is essentially a sub-account tied to your main account, and it’s where any rewards from promotions and campaigns are credited. You also have the option to create a Save Pocket, which can be used to set aside money. Funds moved to any Pocket get a 1% per annum bonus rate applied.

Speaking of which, you get your main savings account, as well as a Ryt Pocket. The bank offers an interest rate of 3% per annum, which is credited to the account each day. Meanwhile, the Ryt Pocket is essentially a sub-account tied to your main account, and it’s where any rewards from promotions and campaigns are credited. You also have the option to create a Save Pocket, which can be used to set aside money. Funds moved to any Pocket get a 1% per annum bonus rate applied.

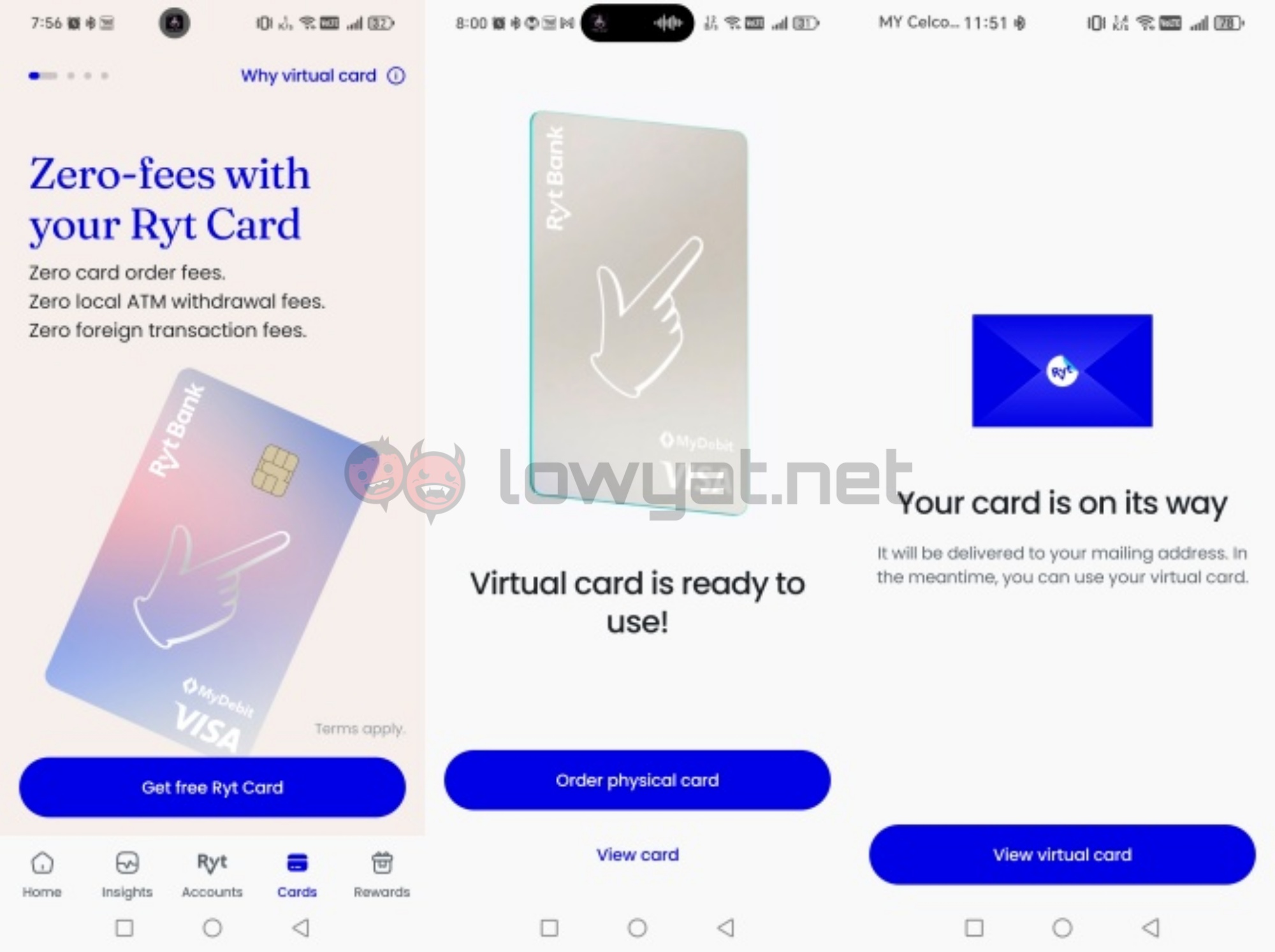

Beyond that, you also get a Visa debit card. It’s a virtual card, but you have the option to order a physical one for an issuance fee of RM12. For now, though, the fee is waived. The default spending and withdrawal limit for the card is RM3,000, but you can change it in the card settings. The app also lets you freeze the card, as well as manage other aspects like overseas transactions.

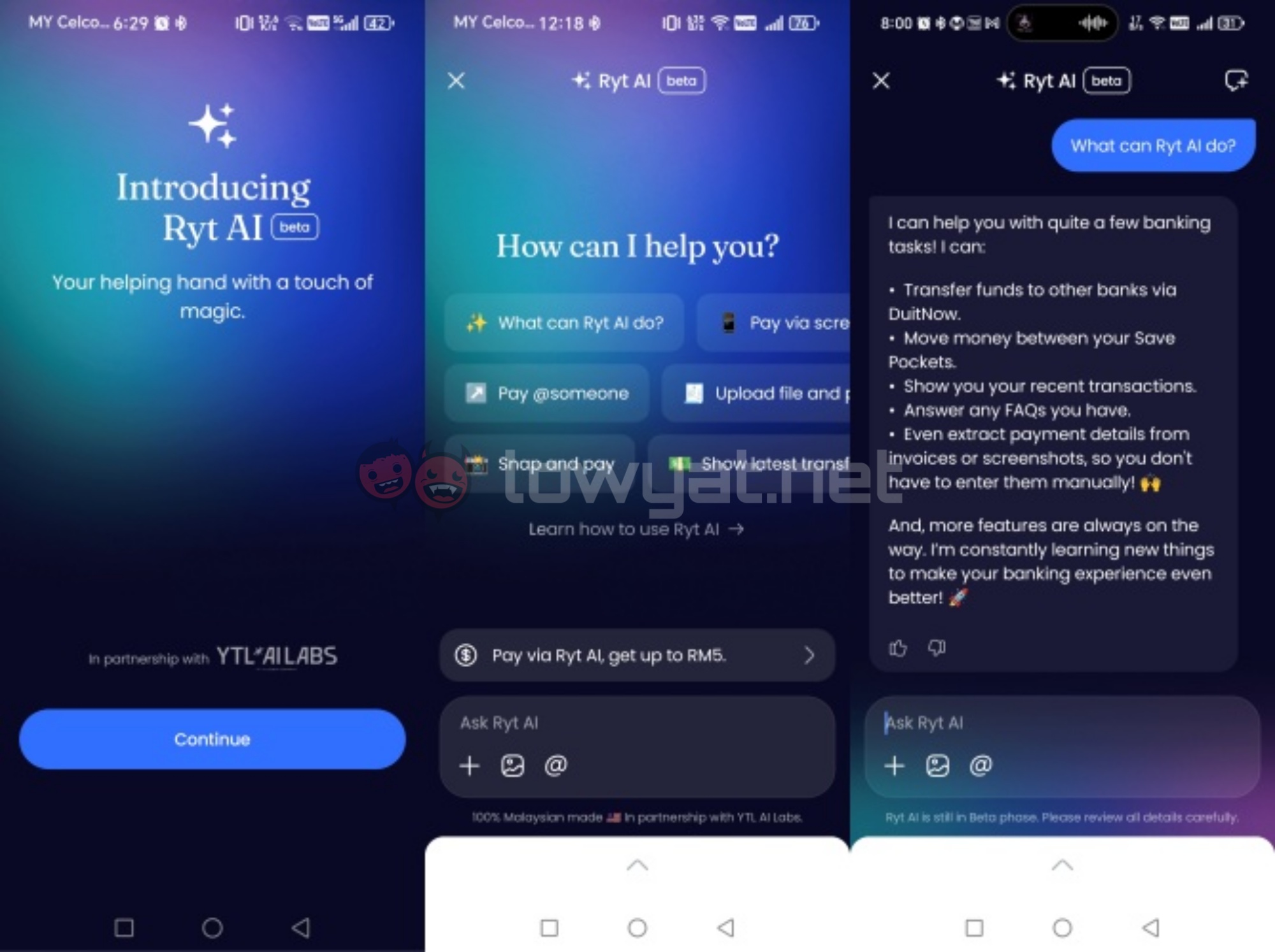

And now, we come to Ryt Bank’s darling, the Ryt AI chatbot. It’s powered by the ILMU large language model (LLM), and it lives in a shiny button at the top of the app’s home page. You can chat it up as you would with any other LLM, but the app offers some suggestions on what it can do.

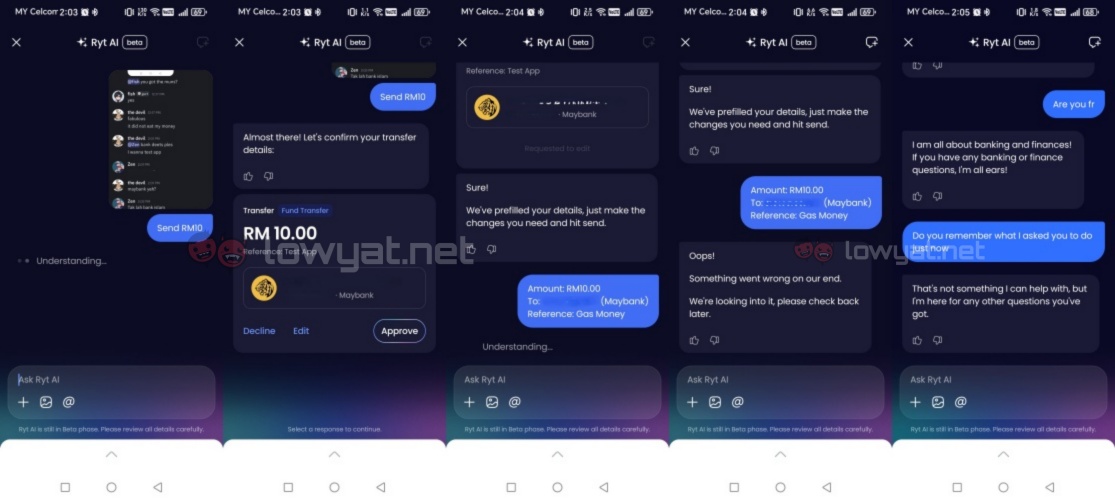

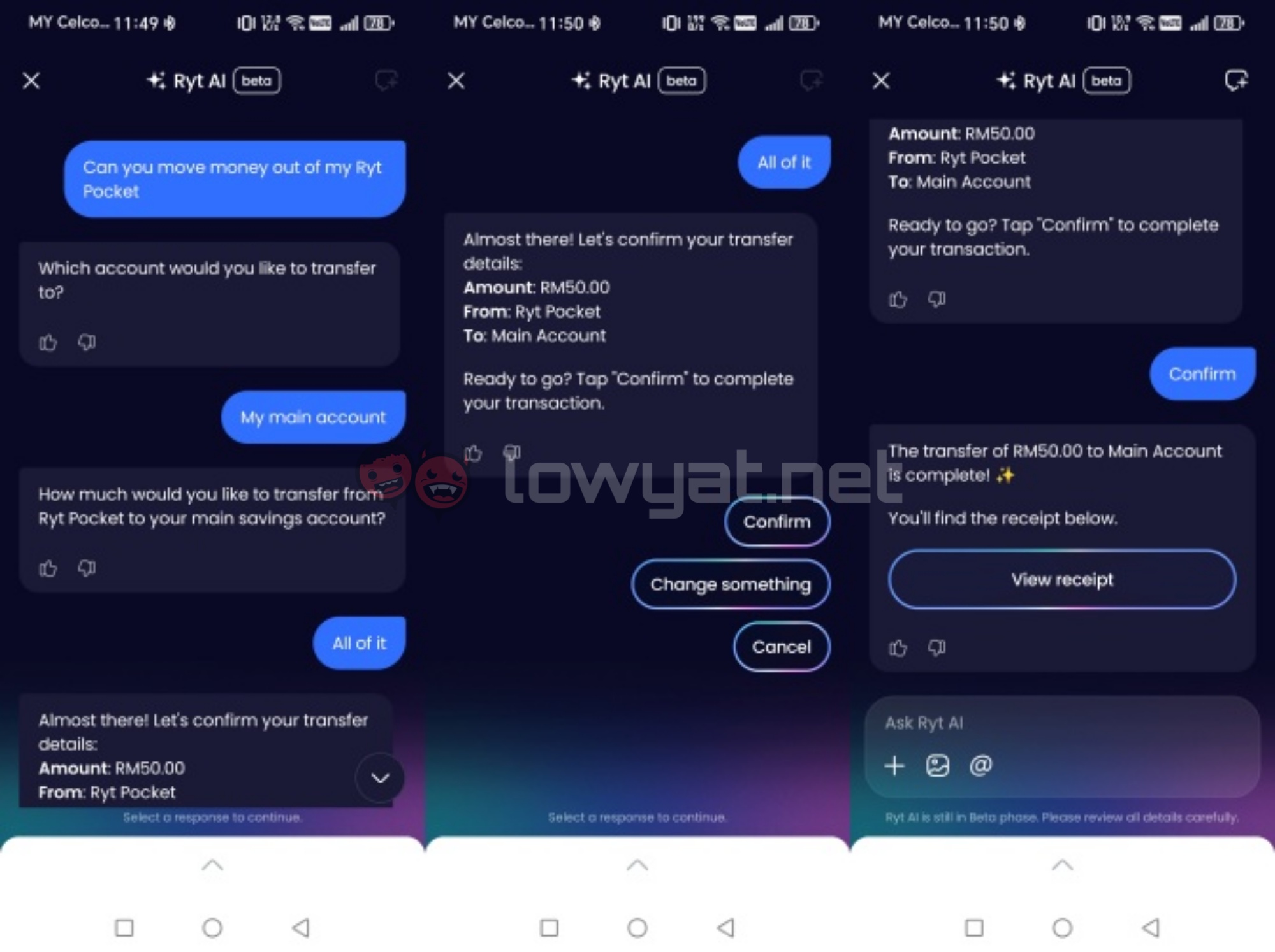

Basically, it can handle fund transfers and payments, and there are quite a few ways to go about it. Some options include uploading a file or a screenshot. You can also tell it to pay a specific person in your contacts. Of course, the receiver must have a DuitNow ID tied to their phone number. The bot will let you know if it doesn’t have enough information to make the transfer, and you can fill in the blanks.

Of course, these transactions still require user approval. The AI will display all the details for the transfer, and you have the option to make changes if necessary. If everything is in order, you can simply tap the “approve” button. It goes without saying that you can also move money between your main account and your Ryt Pocket or any Save Pocket with Ryt AI too.

Of course, these transactions still require user approval. The AI will display all the details for the transfer, and you have the option to make changes if necessary. If everything is in order, you can simply tap the “approve” button. It goes without saying that you can also move money between your main account and your Ryt Pocket or any Save Pocket with Ryt AI too.

It is worth noting that the transfers are not always a smooth process as the bot can get confused in some instances. That probably can be chalked up to the fact that it is currently in beta. Other than that, it takes its sweet time to understand and respond to user input, and quickly forgets past information. The latter might be for the best, though.

Of course, you can perform all your banking tasks manually, if that’s what you prefer. While Ryt Bank does position its Ryt AI as an important part of its services, you can ignore its existence without missing much. That said, using the AI does take away some of the tedious aspects of banking. The chatbot interface gives it a more relaxed feel, which some might appreciate.

Overall, it seems like Ryt Bank is off to a pretty decent start. The app itself is pretty intuitive even when you’re not relying on the AI. As for Ryt AI itself, while it clearly is not as advanced as the LLMs people are generally familiar with, it does serve its purpose. It could do with some improvements in terms of speed and responsiveness, though.