Maybank’s digital banking and wallet platform MAE is celebrating its fifth year of operation with a series of special promotions and upcoming feature updates. The bank revealed that nine out of 10 MAE users actively use the app daily for transactions, highlighting its strong adoption among Malaysians.

According to Maybank, its app now has 10.7 million users, giving it a 48% market share in the mobile banking segment. Since its launch five years ago, the platform has processed transactions worth over RM4 trillion, reflecting the bank’s success in driving digital financial services adoption across the country.

To mark the milestone, Maybank is introducing a limited-time 5% p.a. return promotion for MAE wallet deposits. From 30 October 2025 to 31 January 2026, users who deposit a minimum of RM200 and enter “MAETurns5” in the recipient reference section before 30 November 2025 will be eligible. The deposited amount must remain in the wallet until the end of the campaign period to qualify for the return.

Maybank also announced plans to double the MAE wallet limit to RM20,000 starting next year, making it more convenient for users who rely on the wallet while travelling abroad. Community Financial Services Group CEO Taufik Albar said the decision was made following increasing requests from users for a higher limit.

Meanwhile, Maybank Group Chief Digital Officer Kalyani Nair shared that the bank will expand QR payment support to more countries next year, allowing users to make seamless cross-border transactions. Those mentioned include India, Korea, and China.

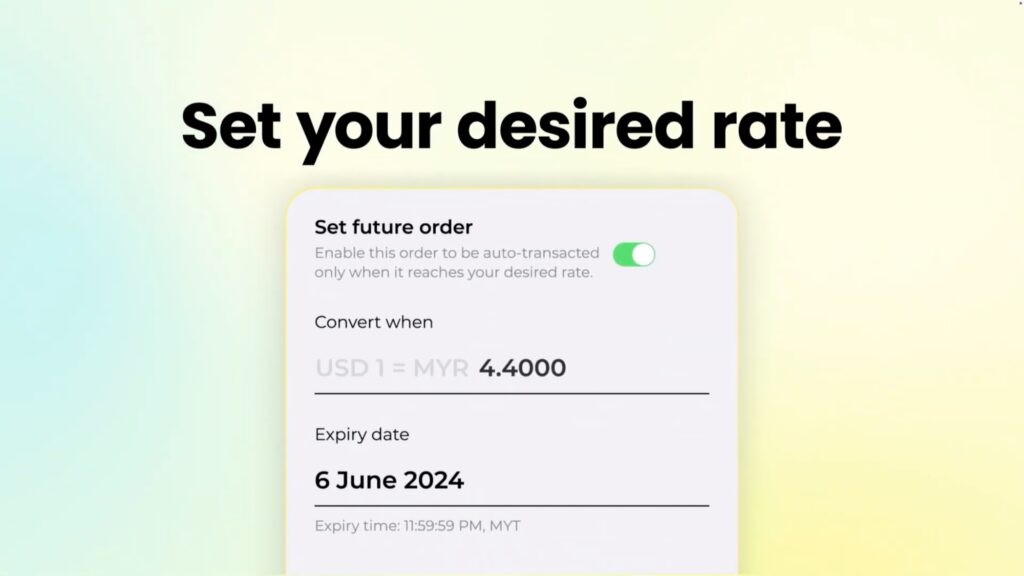

The bank also revealed additional app enhancements that are also “coming soon”. Global Access Account-i users will soon be able to set preferred conversion rates and exchange currencies when rates are favourable, as well as receive rate change notifications. Customers will also be able to open new ASNB accounts directly through the app, whereas credit card users will gain the ability to view and redeem TreatsPoints within MAE. Meanwhile, the option to apply for micro insurances is also in the works.