CIMB Group Holdings Berhad officially unveiled its latest business-centric app, CIMB OCTO Biz. The purpose of the app is to assist users — both new and seasoned — in growing their businesses.

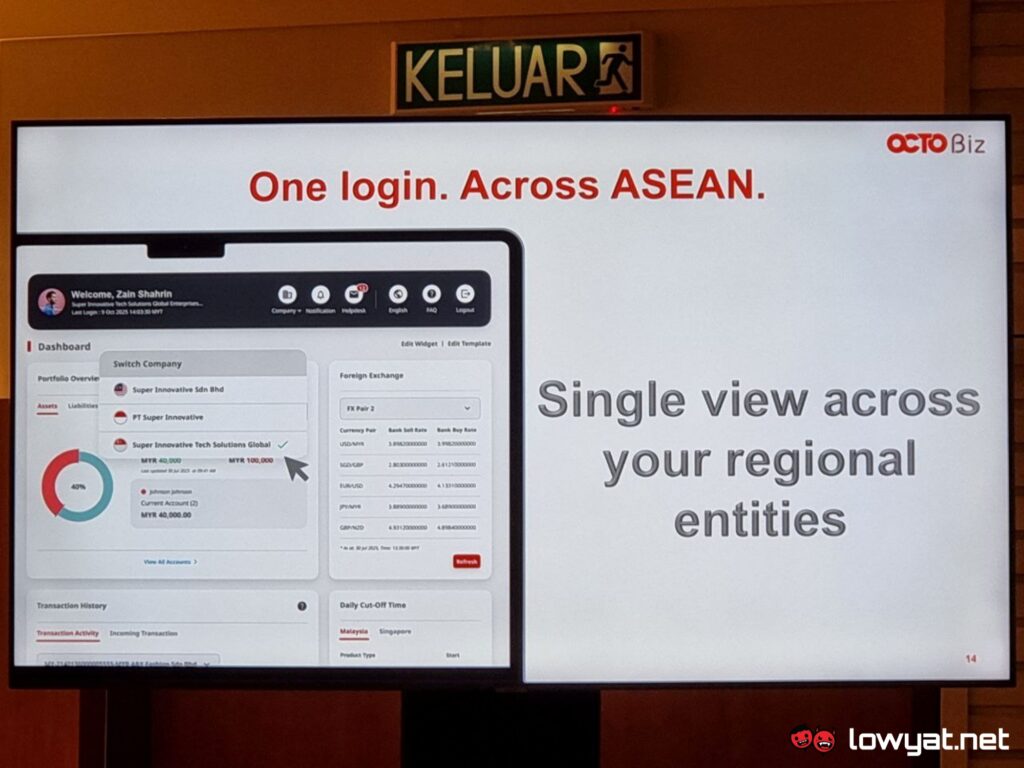

This digital-first strategy allows sole proprietors, SMEs, and corporate clients to seamlessly operate their businesses across ASEAN markets. As a result, CIMB becomes a trusted partner for both local and international business expansion.

“We see banking as a strategic enabler of growth, transformation and financial inclusion,” said Novan Amirudin, Group CEO of CIMB. “Our focus is to equip businesses and communities with capabilities and insights necessary to navigate a dynamic economic environment. The launch of CIMB OCTO Biz underscores this commitment by delivering secure, seamless, inclusive and future-ready financial solutions that support sustainable business expansion across ASEAN and beyond.”

CIMB OCTO Biz has everything an established or budding business owner needs. With AI and data-driven insight, users of the app have access to the real-time cash flow dashboards and financing applications. This gives them greater control and visibility over their finances.

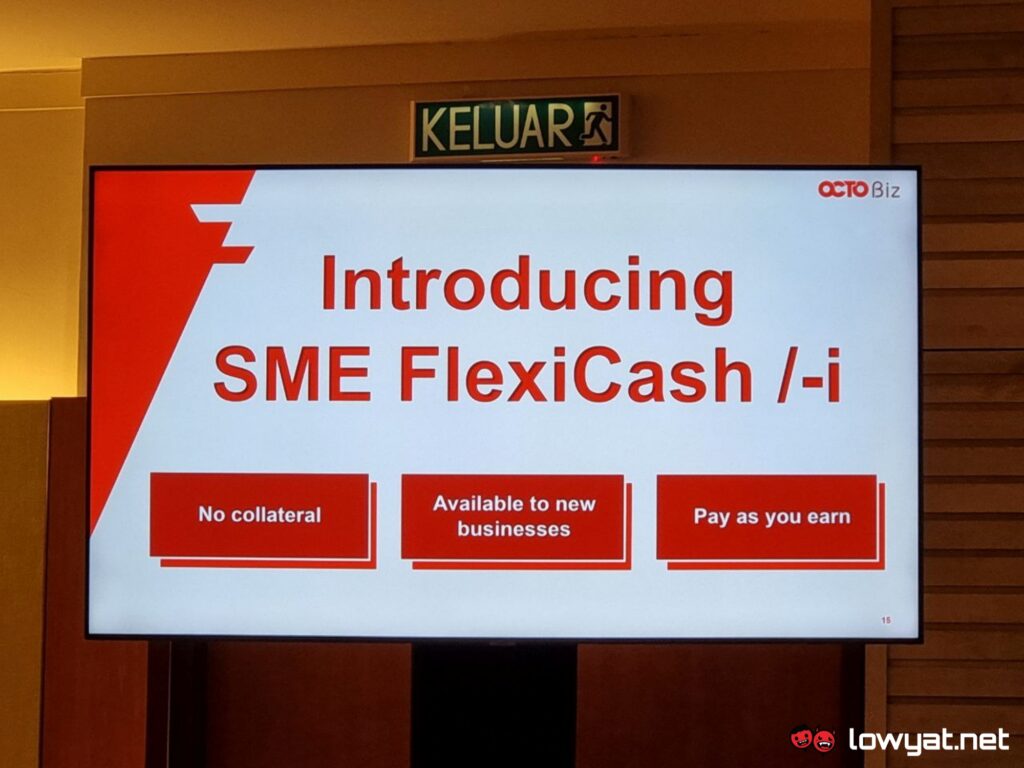

Outside of having a single app to manage a user’s businesses across ASEAN, what differentiates OCTO Biz from other banking apps is its FlexiCash/-i system. This feature eliminates the administrative burden of traditional loan applications by analysing transaction patterns and account history to provide businesses with a pre-qualified financing limit instantly, even without collateral.

Furthermore, this revolutionary system allows businesses to repay based on an agreed percentage of their business’ earnings rather than on fixed monthly instalments. This innovation allows SMEs and start-ups to stay afloat even when there’s little cash flow. Users can apply for this system on the official website or app.

However, just because a business is operational, that does not mean CIMB OCTO Biz will no longer aid you in your venture. The app will proactively find and suggest pertinent goods and services based on the distinct business profile of each user.

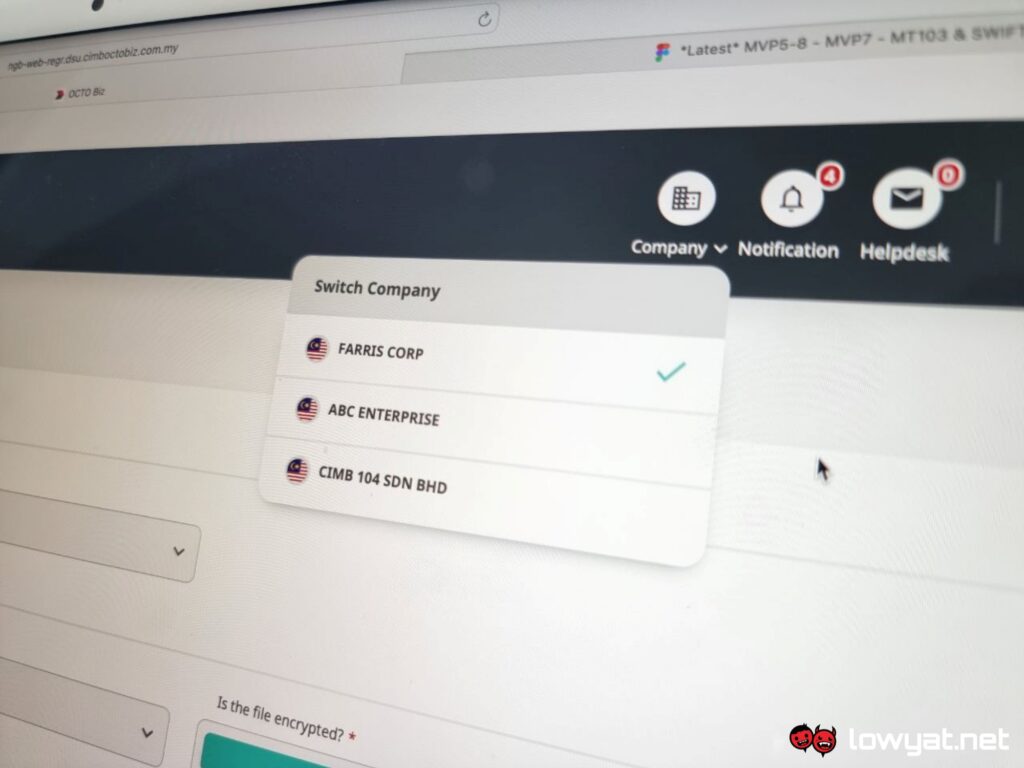

As your business grows, there will come a time that a user may possibly expand their operations beyond Malaysia and operate across ASEAN. With just a click of a button, users can instantly operate and manage various companies within Southeast Asia from the comfort of their homes. It is worth noting that CIMB OCTO Biz will be rolled out in Indonesia and Singapore in the first half of 2026, followed by Cambodia and other ASEAN markets progressively.

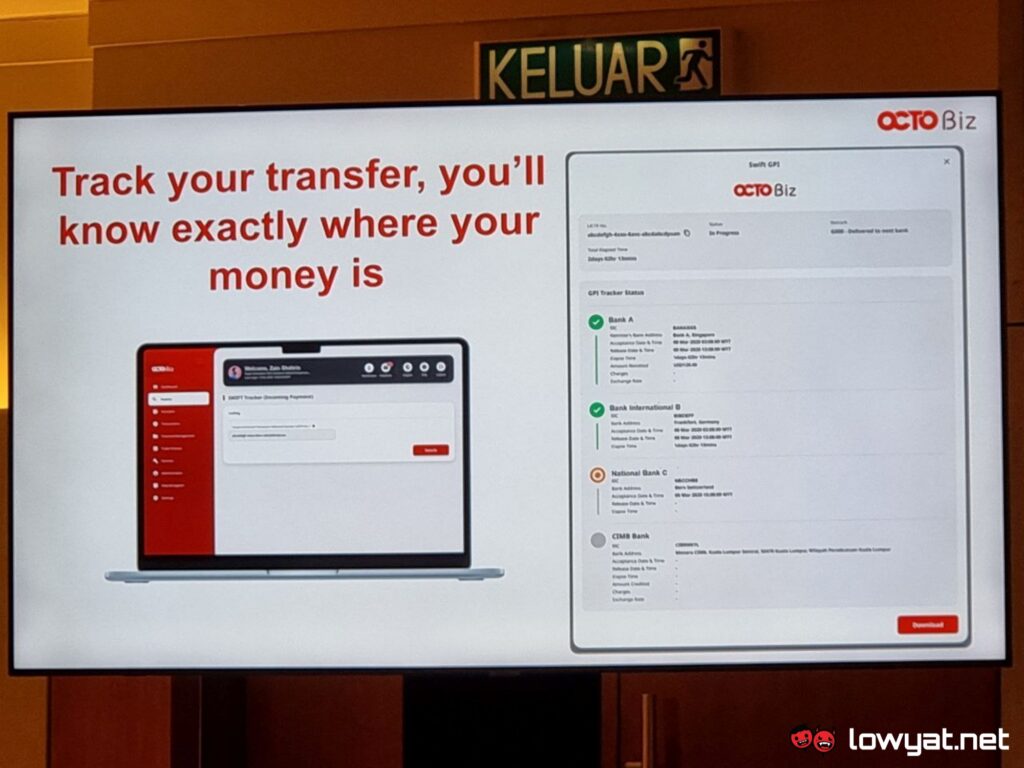

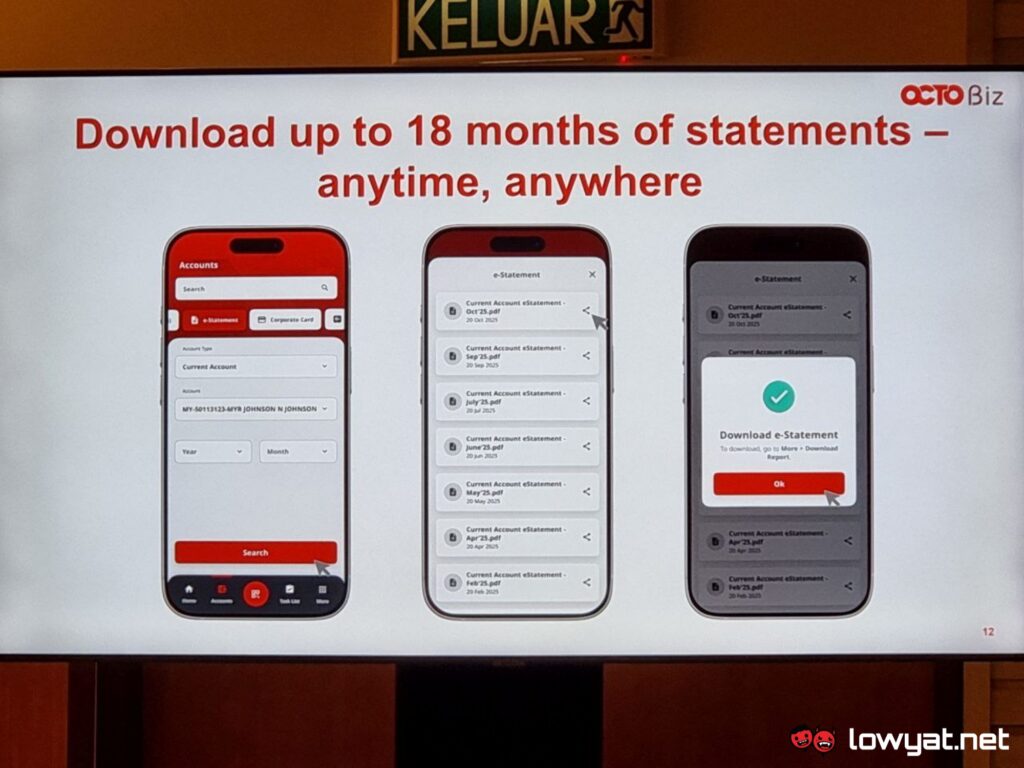

What is more impressive is that CIMB will also provide comprehensive reports when users conduct a transfer, letting them know exactly where their money is. Furthermore, if users are in need of a summary of all financial transactions, CIMB now lets them download up to 18 months of statements from their devices without needing to visit the bank.

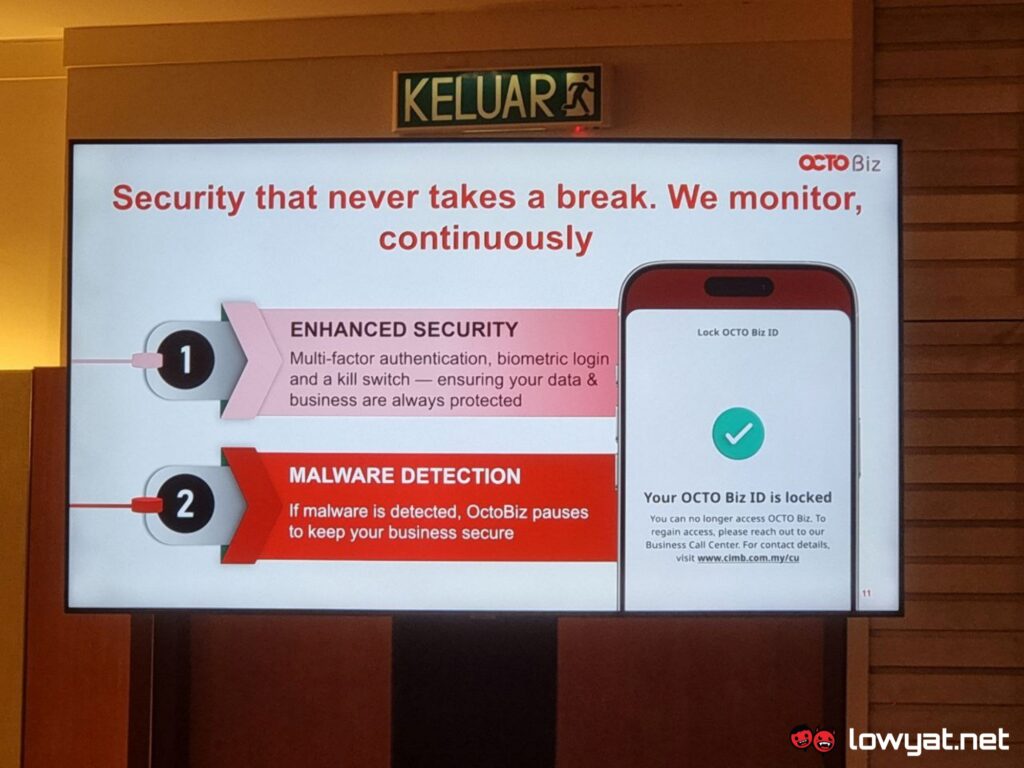

Additionally, if malware ever compromises a user’s device, the CIMB OCTO Biz will immediately lock the victim’s ID to stop unauthorised transactions. This is on top of CIMB’s kill switch, biometric login, and multi-factor authentication systems.

Thanks to CIMB OCTO Biz’s robust security system and its revolutionary FlexiCash/-i model and even its one-login system across ASEAN, starting a business and expanding it across ASEAN has never been easier. The CIMB OCTO Biz app is available now on the Apple App Store, Google Play Store, and Huawei AppGallery, as well as on browsers. For more information, kindly visit CIMB OCTO Biz’s official website here.

This article is brought to you by CIMB.