Maybank Islamic and Perodua have jointly introduced the country’s first Shariah-compliant agility financing plan, designed to offer customers greater flexibility and accessibility in vehicle ownership. Known as the Perodua Flexiplan and powered by Maybank Islamic’s MyImpact Drive Financing-i, the scheme marks a first-time collaboration between the two companies.

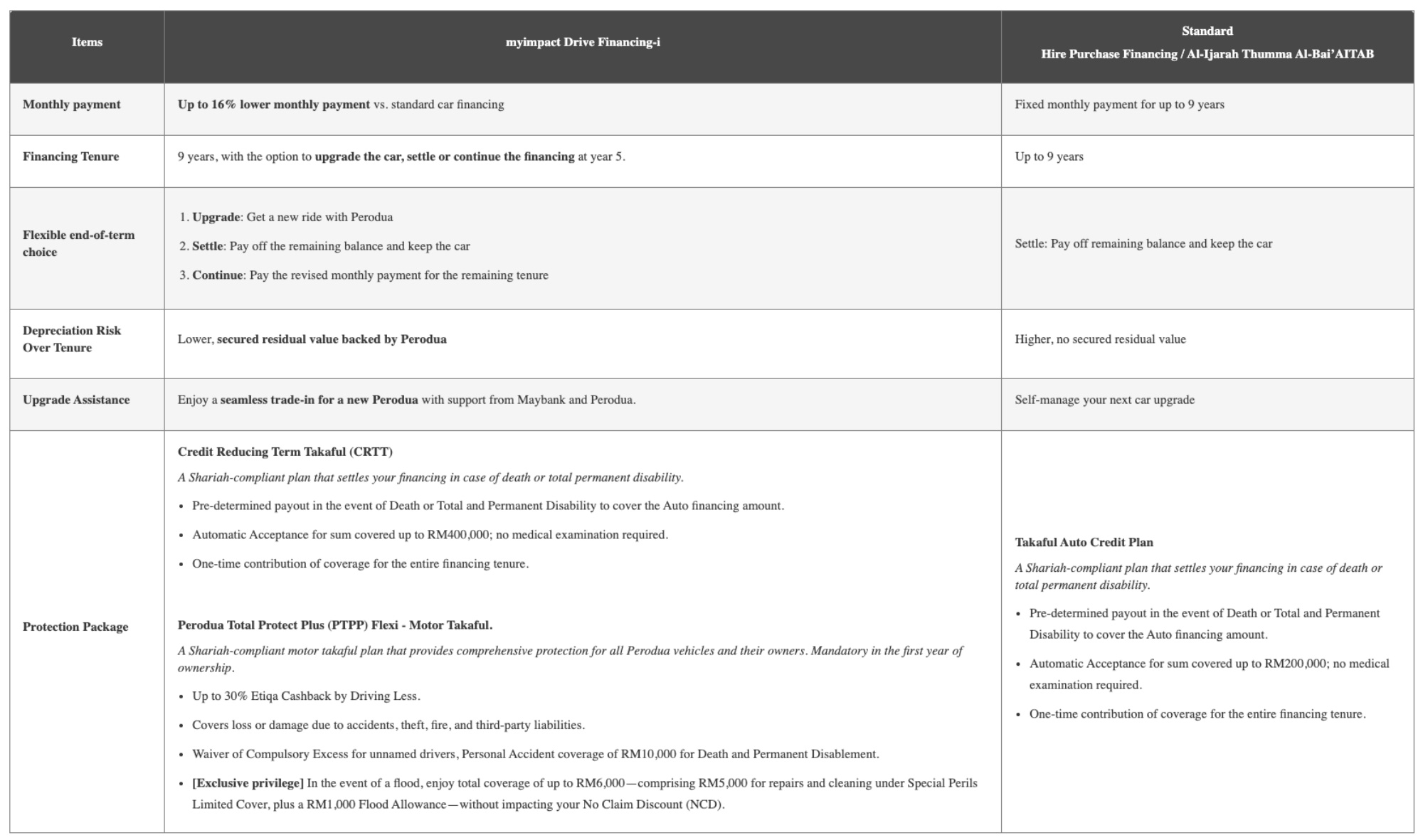

The financing is based on a Murabahah vehicle term arrangement, enabling lower monthly payments over an initial five-year term. At the end of this period, customers can choose to trade in their vehicle for a new Perodua model, with the company offering a buy-back price competitive with market value. Alternatively, they can opt to retain their existing vehicle under a revised payment plan for up to an additional four years.

According to Perodua president and CEO Datuk Seri Zainal Abidin Ahmad, the Flexiplan is available for four models: the Myvi, Axia (excluding the Axia E), Ativa, and Aruz. The collaboration also incorporates other Shariah-compliant offerings such as the Perodua Total Protect Plus comprehensive takaful underwritten by Etiqa, which includes RM5,000 special peril coverage, as well as Credit Reducing Term Takaful for added protection.

Both companies say the initiative is aimed at creating a win-win arrangement for all parties, making car ownership more accessible while offering customers the ability to adapt their vehicles to different life stages. They also view the plan as setting a new benchmark for Malaysia’s automotive financing landscape.

(Source: New Straits Times / Maybank [official website])