Bank Negara Malaysia has asked financial institutions to move away from SMS OTP back in 2022. A fair number have announced a move in this direction, and the latest addition to the list is Bank Islam, which is reportedly moving away from that mode of authentication starting the middle of the month.

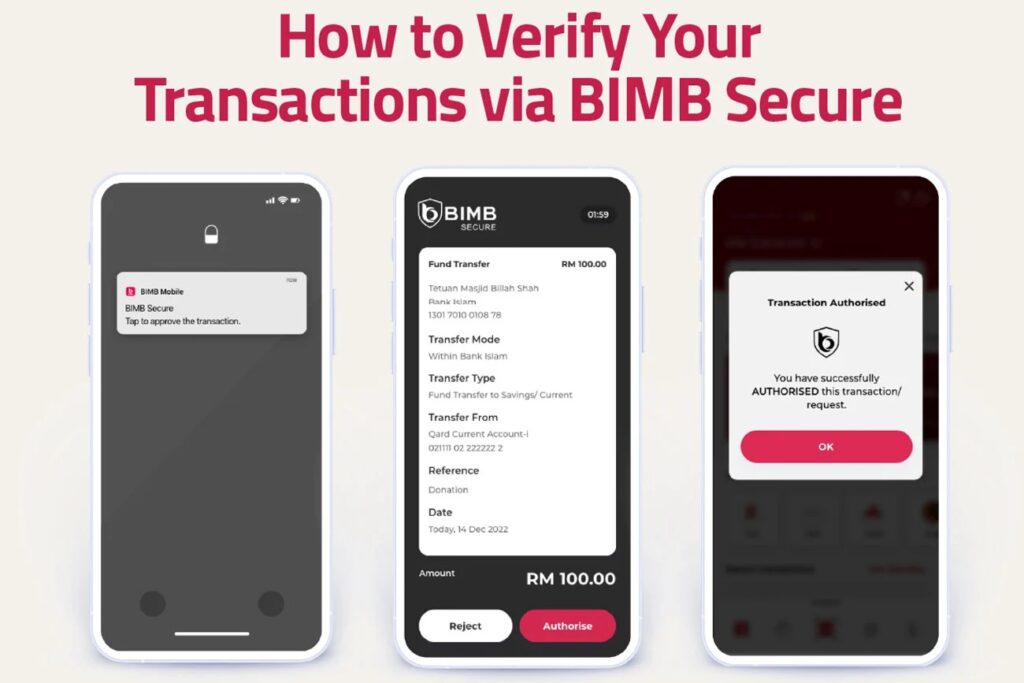

Rnggt reports that starting 15 July, Bank Islam will require that online transactions be done via BIMB Secure. This includes transactions using debit and credit cards, as well as e-commerce payments. By extension, this means using the BIMB Mobile is now mandatory.

Previously, Bank Islam only needed BIMB Secure for transactions performed via BIMB Mobile or Web, as well FPX transactions. The change will mean that the experience will be much like CIMB with its Octo app, as well as MayBank with MAE, though the latter does go a step further by requiring its Secure2u to be activated at ATMs.

For customers of the bank who don’t already have the BIMB Mobile app, it can be downloaded via the Apple App Store for iOS devices, or the Google Play Store for Android. Both are linked below. Alternatively, you can head over to the dedicated page for BIMB Secure to find out more, though it has yet to be updated to reflect the upcoming change.

(Source: Rnggt, Apple, Google, Bank Islam)