Bank Muamalat has launched ATLAS, its Shariah-compliant digital bank. Positioned as Malaysia’s first fully digital Islamic bank, the new platform reflects Bank Muamalat’s push to redefine Islamic banking through technology and lifestyle-driven offerings tailored to Muslim consumers.

ATLAS is developed in collaboration with Backbase, a global fintech company known for its AI-powered Banking Platform. Founded in Amsterdam in 2003, the firm serves over 150 banks globally, including Islamic financial institutions and major banks across Asia-Pacific. Its platform enables banks to unify services and customer experiences across all lines of business, helping accelerate digital transformation with greater agility and control.

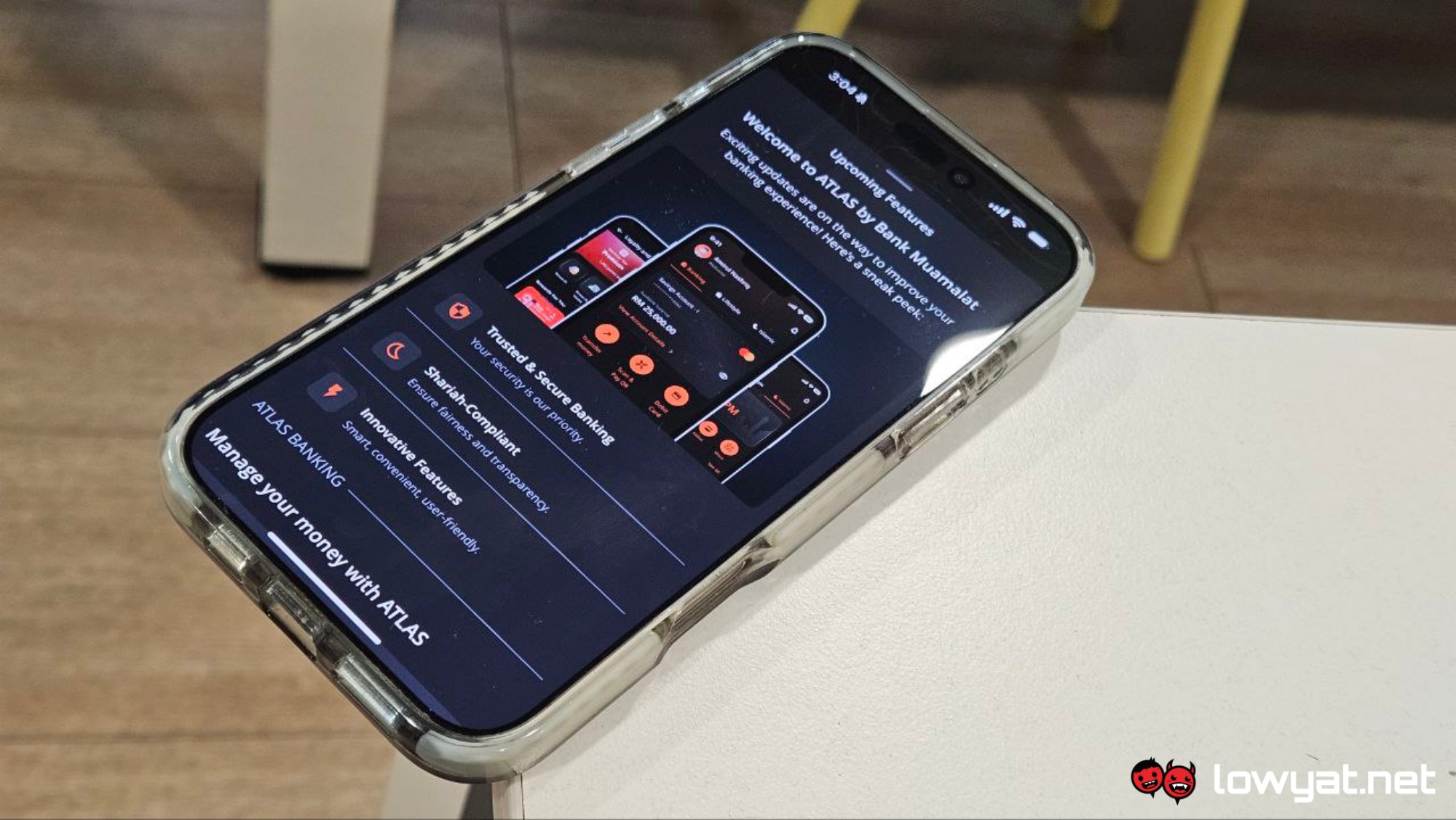

Bank Muamalat touts ATLAS as a seamless digital banking experience, featuring fast onboarding, DuitNow integration, personalised servicing, and Islamic financing products. According to its FAQ page, the digital bank is licensed under the Islamic Financial Service Act 2013 and regulated by Bank Negara Malaysia (BNM). The bank notes that the platform has already shown promising results in its pilot phase, improving customer acquisition efficiency and reducing time-to-market for new offerings.

“[ATLAS] is a bold reimagination of Islamic finance for the modern era, built around the values, lifestyles, and aspirations of our customers,” said Bank Muamalat President & Chief Executive Officer Khairul Kamarudin in a statement. “It reflects our commitment to leading the next era of Islamic banking that is digital, inclusive, and purpose-driven.”

Meanwhile, Backbase regional vice president for Asia, Riddhi Dutta, regards the partnership with Bank Muamalat as a clear demonstration of how the AI-powered Banking Platform enables personalised, scalable digital banking. He notes that ATLAS highlights the company’s role in modernising Islamic banking and expanding its footprint in the sector.

Looking ahead, Bank Muamalat plans to introduce digital debit and credit cards, flexible personal financing, and a Shariah-compliant gold investment account within ATLAS. A lifestyle rewards programme is also being introduced, connecting users to curated benefits from partner brands across various industries.

As with most digital banks, ATLAS and its services are offered via mobile devices. However, it is only offered for iOS at this time, while the platform’s Facebook page notes that the Android will be “available soon”. Additionally, you can register for a new account through the app, and while ATLAS does have an official website, it mainly functions to provide further information of its services to existing and new customers.

(Source: Bank Muamalat press release)