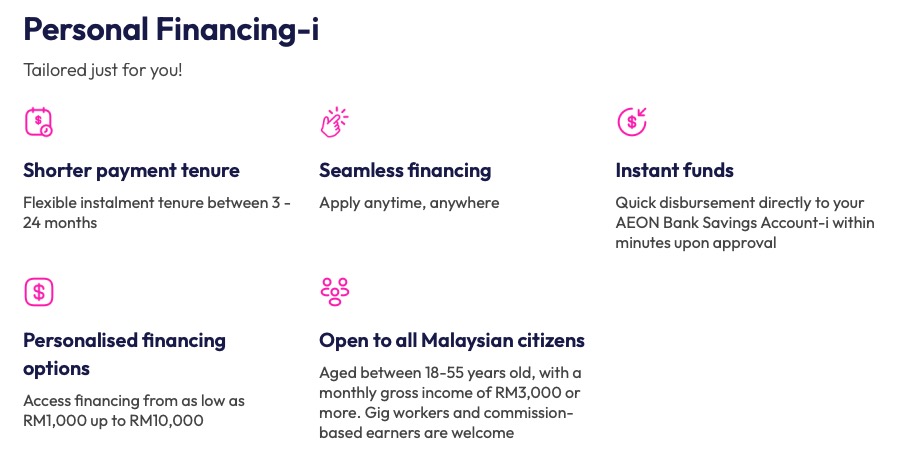

AEON Bank, the digital bank by AEON, has just launched a new Shariah-compliant personal financing product called Personal Financing-i. The feature allows users of the digital bank to apply for a personal loan right through the app, ranging from RM1,000 to RM10,000 or up to your credit limit, whichever is lower.

The loans are offered with a flexible tenure that can range from as little as three months up to two years. Once your application has been approved, you will have seven days to decide whether to accept or reject the offer. As for how much it will cost, AEON Bank will charge a RM1 Wakalah fee as well as a flat profit rate (which is essentially the same as an interest rate) of 6.88% p.a.

You may not change the tenure length once your application has been approved nor can you make advanced payments, but you do have the option of making an early full settlement, which, according to the T&C, will entitle you to a rebate on the profit rate.

Monthly payments for the loan are automatically deducted from your AEON Bank savings account but if the auto-deduction fails, you will have to make the payment manually through the app. Late payments will be subjected to a 1.00% p.a. charge on the overdue amount.

To be eligible for personal financing, you will need to have a minimum monthly income of RM3,000. Salaried workers will need to provide an EPF statement with a minimum of contribution of six months, while self-employed individuals & commission earners such as gig workers will need to provide their latest six-month bank statement.

(Source: AEON Bank)