The government has officially shelved its plan to introduce a high-value goods tax (HVGT), more than two years after it was first announced. In a written reply to Parliament on Tuesday, the Ministry of Finance (MOF) confirmed that the proposed tax, previously known as the luxury goods tax, will no longer be implemented in its original form.

Instead, the MOF said that elements of the HVGT have already been absorbed into the existing sales tax framework, specifically targeting luxury and discretionary items with elevated rates. “The elements of the HVGT have been incorporated into the revamped sales tax regime, where luxury and discretionary items are now taxed at rates of 5% or 10%,” it stated.

The update was issued in response to a question by Datuk Shamshulkahar Mohd Deli (BN–Jempol), who had asked about the expected revenue gains from the government’s series of tax reforms. These included the HVGT, a digital goods tax (DGT), capital gains tax (CGT), low-value goods tax (LVGT), and expansions to the sales and service tax (SST).

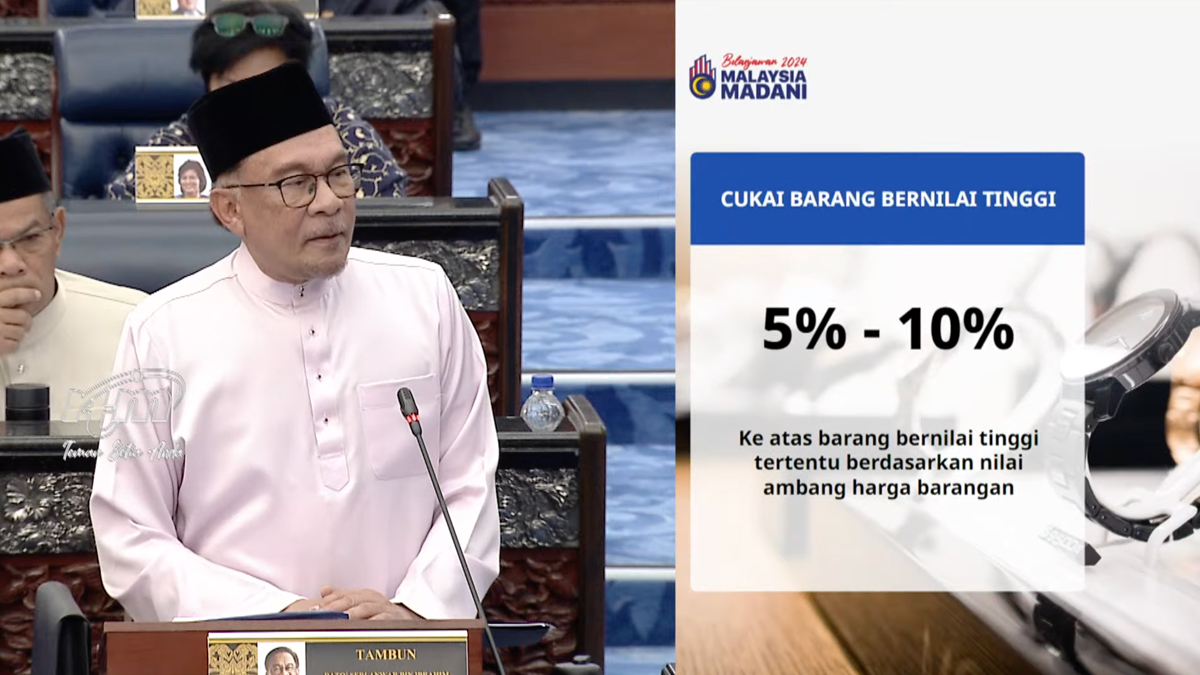

First introduced during the tabling of Budget 2023 by Prime Minister Datuk Seri Anwar Ibrahim, the HVGT was designed to target high-end consumer goods with a tax rate ranging from 5% to 10%. At the time, it was projected to generate approximately RM700 million annually, with a rollout date initially set for 1 May 2024.

However, the plan encountered resistance from various industry stakeholders, particularly jewellers, who warned that a low-value threshold could harm sales and stifle business recovery in a post-pandemic environment. This eventually led to delays and, now, the abandonment of the HVGT as a standalone measure.

(Source: The Edge Malaysia)