The local automotive industry will be moving from Customised Incentives (CI) to a fixed, more transparent and fairer tax system in October this year. This was revealed by Mohd Shamsor Mohd Zain, the President of the Malaysian Automotive Association (MAA), during a press conference yesterday.

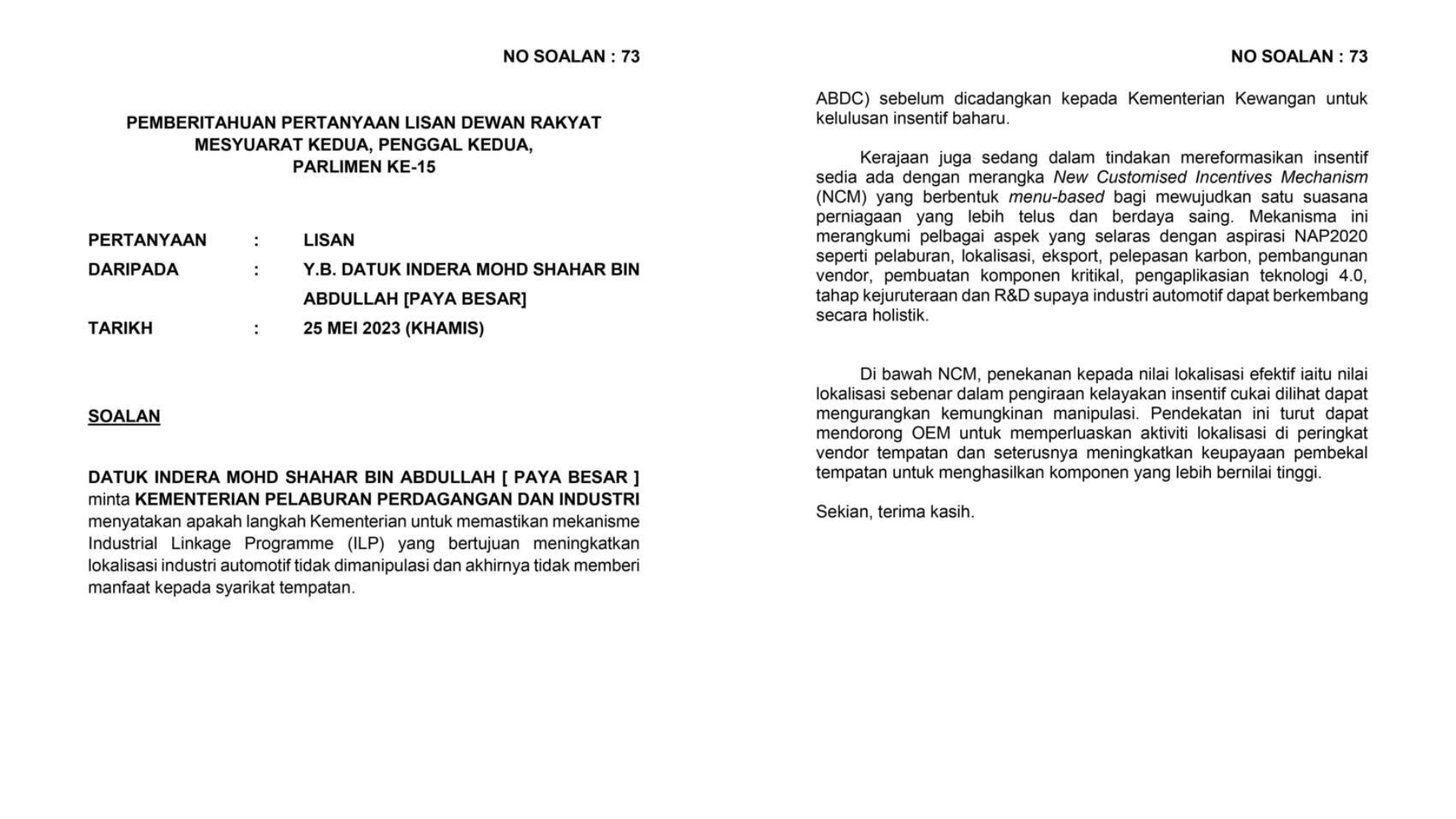

The current CI is provided by the National Automotive Policy (NAP) to attract strategic investments to the country. It is based on a Cost-Benefit Analysis (CBA) and the recommendation of the Automotive Business Development Committee (ABDC), a strategic committee chaired by the Ministry of Investment, Trade, and Industry (MITI). Also involved are the Ministry of Finance (MOF), Royal Malaysian Customs Department (RMCD), Malaysia Automotive, Robotics and IoT Institute (MARii), as well as the Malaysian Investment Development Authority (MIDA).

However, recently MITI announced a New Customised Incentive Mechanism (NCM). This new revised incentive was designed to promote a more transparent and competitive business environment and as a preventive measure to avoid the manipulation of the Industrial Linkage Programme (ILP) mechanism.

This was stated in a written reply to a question from Datuk Indera Mohd Shahar that was posed to Parliament (dated 25 May 2023). Furthermore, it was also added that the revised incentive has various aspects that are in line with the aspirations of NAP2020, such as investment, localisation, exports, carbon emissions, vendor development and many more.

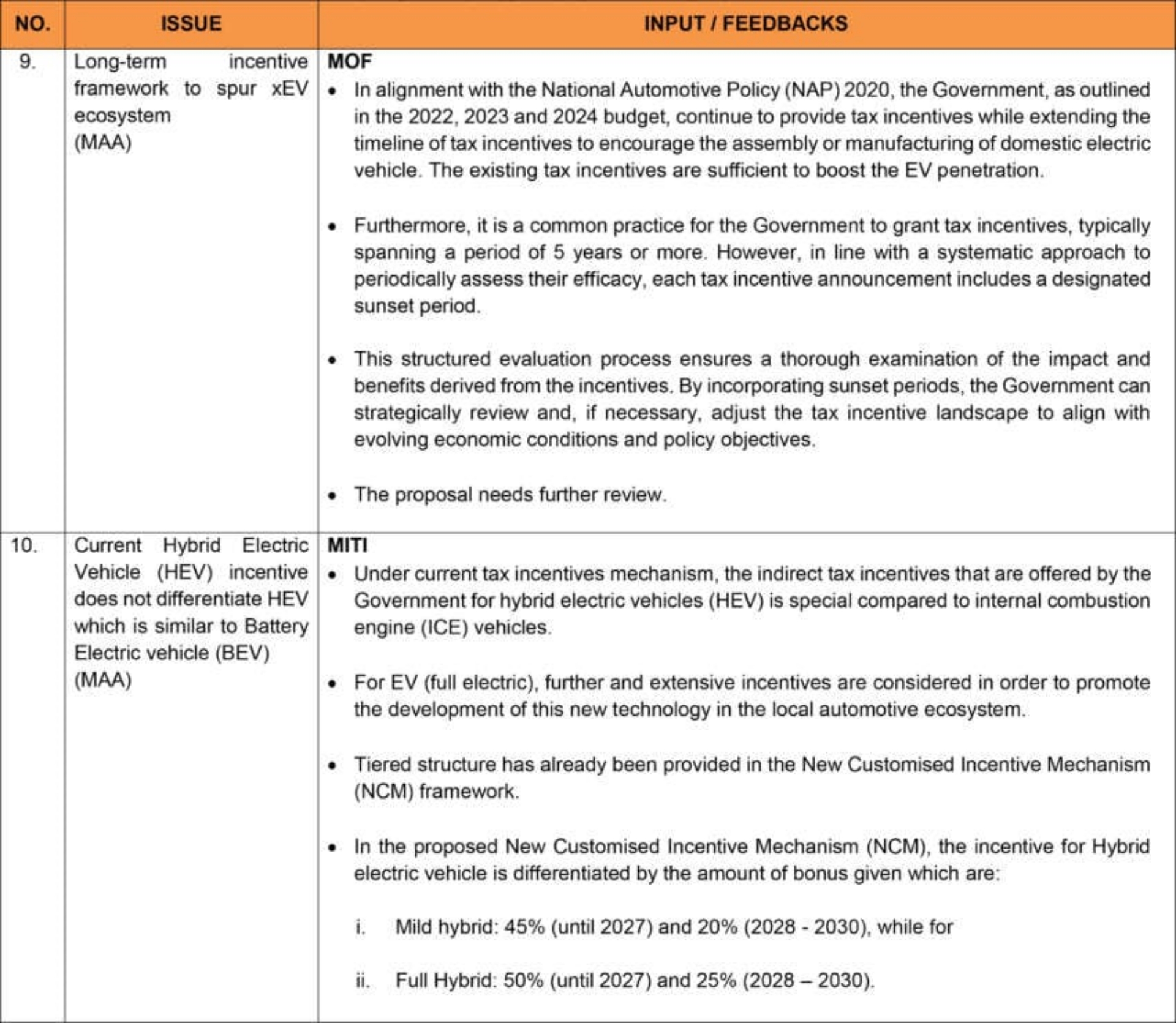

Also, in the MITI Dialogue last year, MAA raised an issue that the current hybrid electric vehicle (HEV) incentive does not differentiate HEV, which is similar to battery electric vehicle (BEV). To which MITI replied that under the current tax incentives mechanism, the indirect tax incentives that are offered by the government for hybrid electric vehicles (HEV) are special compared to internal combustion engine (ICE) vehicles. For EVs (fully electric), further and extensive incentives are considered in order to promote the development of this new technology in the local automotive ecosystem.

The ministry went on to say that a tiered structure has already been provided in the NCM framework. “In the proposed New Customised Incentive Mechanism (NCM), the incentive for hybrid electric vehicles is differentiated by the amount of bonus given,” it noted. The bonuses listed out are:

- Mild hybrid: 45% (until 2027) and 20% (2028 to 2030)

- Full hybrid: 50% (until 2027) and 25% (2028 to 2030)

From this it is evident that the tax incentives in the local automotive scene are not fixed and vary across many aspects. Thus, a fixed incentive would make it much easier to attract investors to our country to invest in the local automotive scene.

(Source: Paultan.org / Malaysia Business Group/ MARII/ Parlimen Files)