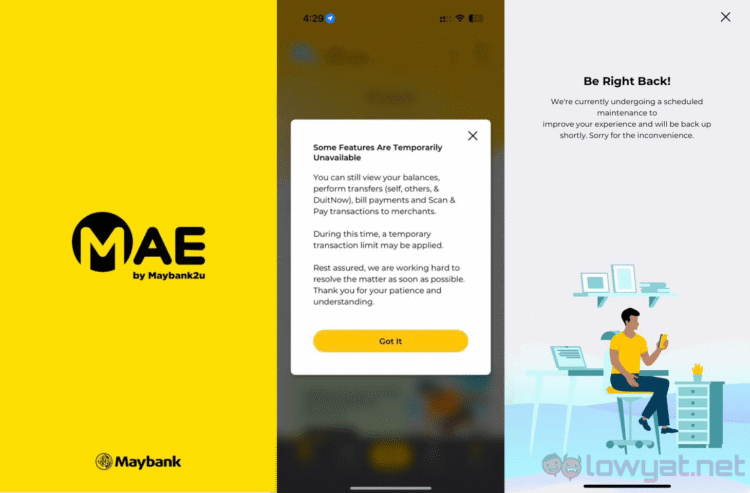

Maybank’s MAE app has been experiencing intermittent disruption issues since earlier today. While a “Some Features are Temporarily Unavailable” message pops up assuring that transfers, bill payments and Scan and Pay transactions are still available – we can independently verify that these features are also affected and unavailable at time of writing.

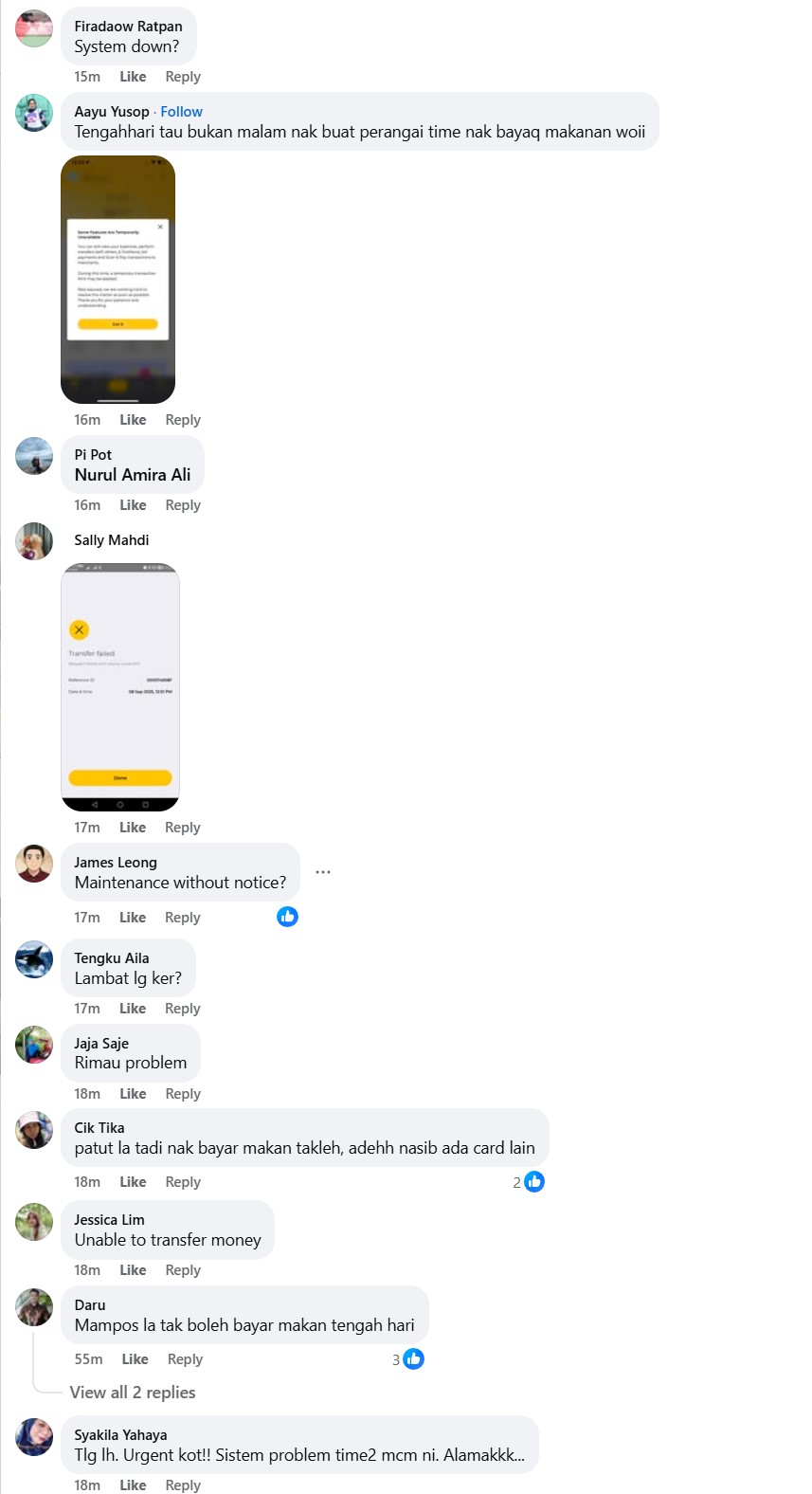

Customers who rely on the MAE app for their daily transactions are once again not impressed with the timing of the outage and have taken to Maybank’s Facebook page to vent out their frustrations.

There is still no official statement from Maybank with regards to this particular outage and how long it would take for the situation to be resolved. As usual, our reminders for those who intend to go fully cashless, always make sure you have a backup cashless payment method on hand to avoid any awkward moments at the cashier counter.

UPDATE – 8 September 2025, 2:30pm:

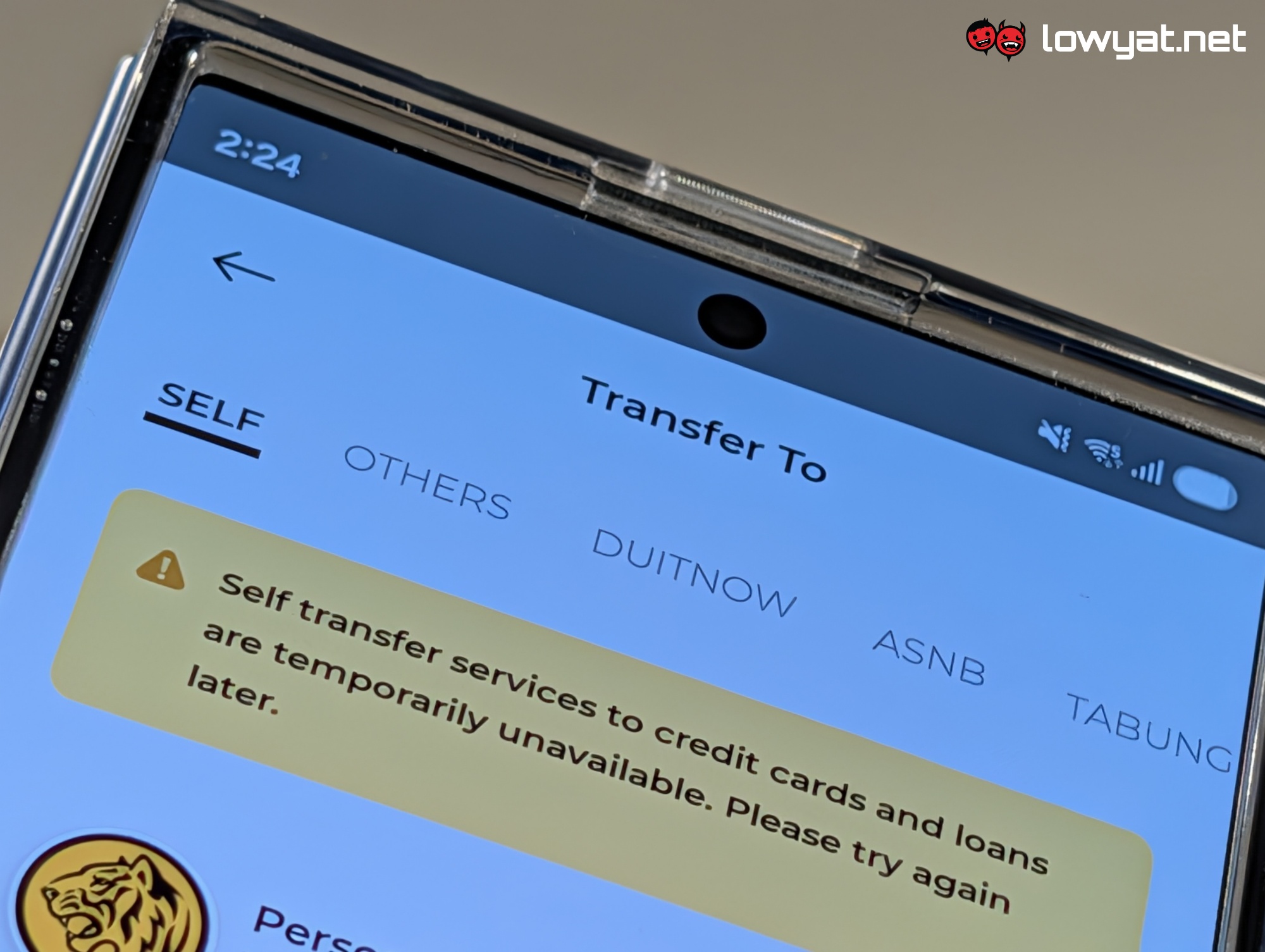

Based on complaints on social media as well as our own findings, affected Maybank services include Secure2U, QR Payment, and certain fund transfer services. Meanwhile, the bank’s website and MAE app notes that self-transfer services to credit cards and loans are temporarily unavailable, whereas a temporary transaction limit may be applied to some features.

With Secure2U down, users are instead prompted to authorise transactions via a six-digit TAC, delivered as push notifications through the MAE app. It’s worth noting that Malaysian banks no longer send these codes via SMS, as the method was phased out in 2021.

As for actual transactions, online bank transfers appear to remain functional, but QR-based payments are still seeing widespread issues. Many users have reported that QR payments to merchants with Maybank accounts are currently unable to go through.

UPDATE – 8 September 2025, 5:11pm:

Maybank says services via its Maybank2u website and MAE mobile app have been fully restored. However, some mobile users continue to report issues with features such as transfers and payments. In response, the bank is advising customers to completely close the app — including removing it from the background — and then relaunching it.

Unfortunately, the bank has yet to disclosed what had caused the issue.