NVIDIA saw a very profitable fiscal Q4 2025 year, with a sales increase of 78% year on year or US$39.3 billion (~RM175 billion). Of that amount, Blackwell GPU sales accounted for US$11 billion (~RM48.9 billion) of it.

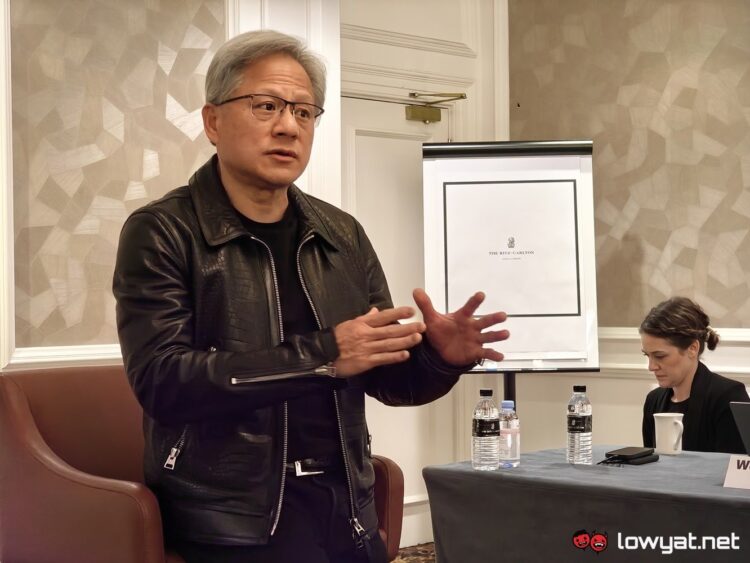

NVIDIA’s strong finish of the fiscal year also resulted in its net income rising 14% sequentially and as Jen-Hsun Huang, CEO of NVIDIA says, can be attributed to the rising demand for AI chips, particularly in the datacentre and machine learning industry. The Blackwell factor, in particular, is the company’s “fastest product ramp” in the company’s history.

“Demand for Blackwell is amazing as reasoning AI adds another scaling law—increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter,” Huang said. “We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter. AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries.”

On the gaming side, though, NVIDIA’s gaming revenue only pulled in a fraction of the revenue at US$2.54 billion (~RM11.29 billion), down by 22% sequentially and 11% year-over-year. This isn’t entirely surprising, given that the new GeForce RTX 50 Series just rolled out; the purchasing of new GPUs usually slow to a crawl whenever a new generation of GPUs is announced.

That isn’t to say the rollout of the NVIDIA GeForce RTX 50 Series haven’t been without issue. Shipment and production delays notwithstanding, it has come to light that many of the RTX 5090, 5080, and 5070 Ti models have been plagued with their ROPs partially missing.

(Source: Hot Hardware, Yahoo!, FT)