The banking industry in Malaysia has intercepted and prevented over RM780 million worth of fraudulent online transactions between 2023 and 2024. This is according to the Association of Banks In Malaysia (ABM), citing the figures as the result of its efforts under the industry’s #JanganKenaScam campaign.

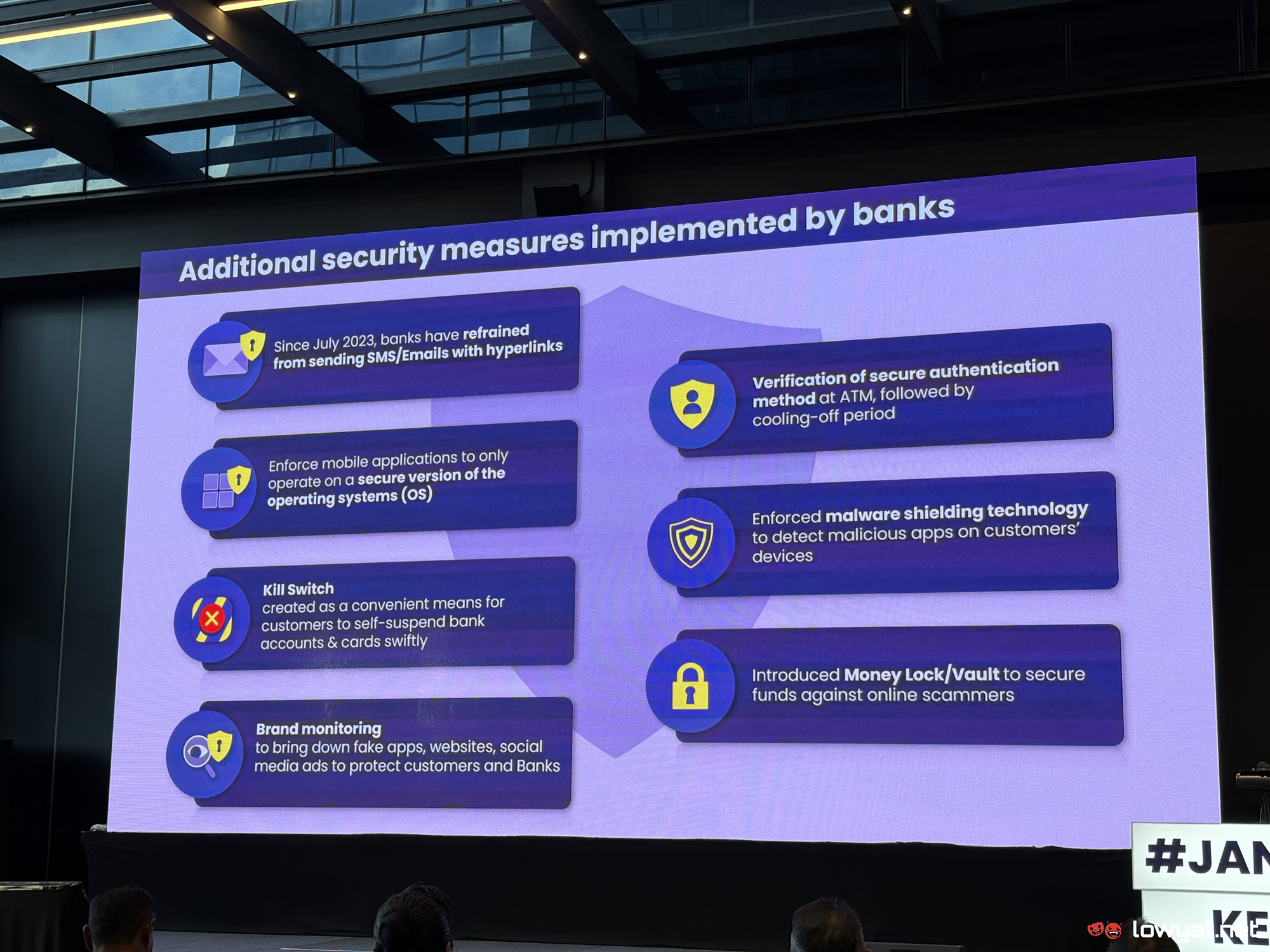

Part of the campaign includes the introduction of several new security features, including secure authentication methods, money locks, kill switches, cooling-off periods, and restriction of mobile apps to only secure operating system versions. Banks have also stopped sending links through SMS messages and email.

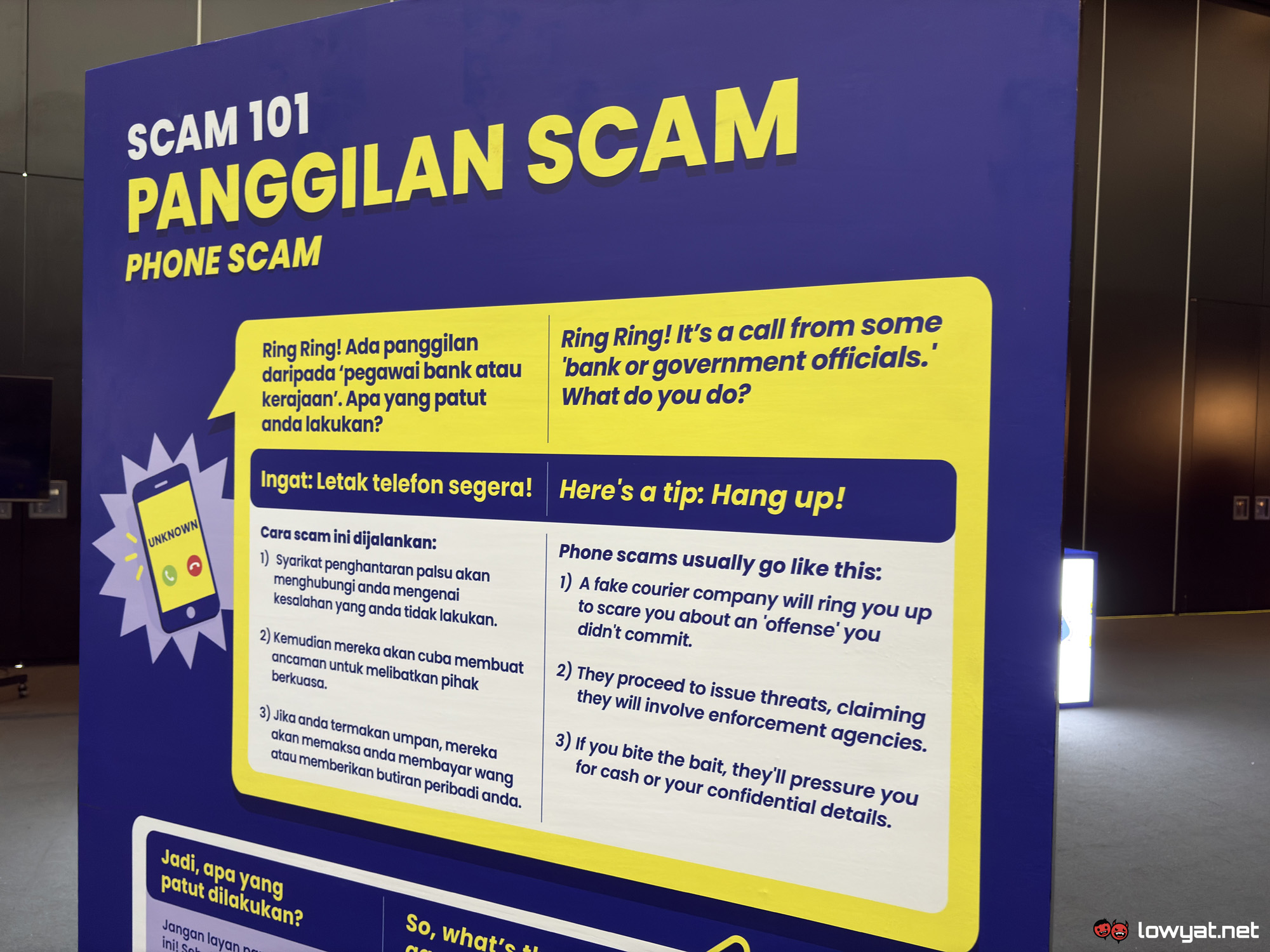

Commissioner of police, Ramli Mohamed Yoosuf, director of the Commercial Crime Investigation Department, added that the police carried out 24,388 raids in 2024 involving commercial crimes, including scams. He also advised the public to not trust any calls from so-called authorities as government bodies will not call individuals. Moreover, fraud victims should immediately call the National Scam Response Centre at 997, followed by contact with their respective bank and a police report.

Prime minister Anwar Ibrahim earlier announced that the government is considering the adoption of a new UK law that requires banks to provide refunds to scam victims. Regarding this, Syed Ahmad Taufik Albar, chairman of the National Taskforce to Combat Fraud and Maybank’s Group CEO of Community Financial Services, pointed out that banks already have a joint culpability policy whereby it would compensate fraud victims up to a certain amount on a case-by-case basis if it was found that the bank could have done more to prevent the incident from occurring.